<script type="text/javascript"><!-- var copyrightUrl = CopyrightPopUp.toString(); //--></script> <script type="text/javascript"> <!-- copyrightUrl = copyrightUrl.substring(copyrightUrl.indexOf('OpenWin("')+9,copyrightUrl.indexOf('orderSource=wsj.com')+19); if(djTypeArticleArray != null && djTypeArticleArray.FREE_ARTICLES_WITH_DJTYPE_FALSE != null){ var djTypeArticles = djTypeArticleArray.FREE_ARTICLES_WITH_DJTYPE_FALSE.split('~'); var metatags = document.getElementsByTagName('META'); var article_displayname = ""; var setDJType = true; for (var i = 0; i < metatags.length; i++){ if (metatags.name == 'displayname') { article_displayname = metatags.content; break; } } for(var i=0; i<djTypeArticles.length && article_displayname != ""; i++){ if(djTypeArticles == article_displayname){ setDJType = false; break; } } if(!setDJType){ copyrightUrl = copyrightUrl.replace("&DJType=true","&DJType=false"); } } function CopyrightPopUp(){ OpenWin(copyrightUrl,"reprints",515,440,"scroll,resizable",true); } // --> </script> <!-- ID: SB122083202593108477.djm --> <!-- LEVEL: normal --> <!-- TYPE: Commentary (U.S.) --> <!-- DISPLAY-NAME: Commentary (U.S.) --> <!-- PUBLICATION: "The Wall Street Journal Interactive Edition" --> <!-- DATE: 2008-09-08 00:01 --> <!-- COPY: Dow Jones & Company, Inc. --> <!-- ORIG-ID: --> <!-- article start --> Detroit's Blackmail Attempt

Is Beyond Shameless

[FONT=times new roman,times,serif][FONT=times new roman,times,serif]By PAUL INGRASSIA

September 8, 2008[/FONT]

[/FONT]

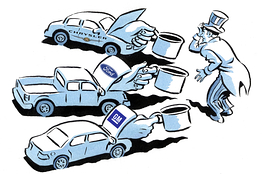

It was only a matter of time, unfortunately. And now that Michigan is an election-year swing state and Detroit's auto makers are posting sales declines topping 20% each month, the time has arrived. The issue of a government bailout for General Motors, Ford and Chrysler is moving to center stage.

Barack Obama has said yes to this proposal early on, and last week John McCain climbed on board. So much for change and fighting pork-barrel spending. We're moving beyond moral hazard here, folks, and into a moral quagmire. At least the Chrysler bailout of 1980 was structured so that taxpayers could reap a reward for taking a financial risk on the company's future. That's not what's happening now.

<table class="imglftbdy" align="left" border="0" cellpadding="0" cellspacing="0" width="262"> <tbody><tr><td>

</td></tr><tr><td class="medcrd">David Gothard </td></tr></tbody></table> Late last year, in its energy bill, Congress authorized $25 billion of low-interest loans to high-risk borrowers -- a strategy perfected by home-mortgage lenders in recent years. In this case the high-risk borrowers are the loss-plagued Detroit car companies. The loans are supposed to help them develop new, fuel-efficient cars, and retool their factories to produce them. Detroit, not being satisfied with this taxpayer largess, wants $50 billion.

</td></tr><tr><td class="medcrd">David Gothard </td></tr></tbody></table> Late last year, in its energy bill, Congress authorized $25 billion of low-interest loans to high-risk borrowers -- a strategy perfected by home-mortgage lenders in recent years. In this case the high-risk borrowers are the loss-plagued Detroit car companies. The loans are supposed to help them develop new, fuel-efficient cars, and retool their factories to produce them. Detroit, not being satisfied with this taxpayer largess, wants $50 billion.

This is bad public policy for reasons of philosophy, practicality and precedent. And by the way, this is a dumb idea for the car companies too, simply in terms of their own self-interest.

Philosophically, if the Freddie Mac and Fannie Mae debacles teach us any lesson, it is that subsidizing private profits with public risk is a terrible idea. Implicit government backing has led the managements of these two companies to make reckless investments that have backfired badly. Now government backing has become explicit, and under the plan announced by Treasury Secretary Henry Paulson yesterday, taxpayers likely will pay billions to keep Fannie and Freddie solvent -- with the exact amount uncertain.

The Detroit Three got into their current quandary by making decades of bad decisions, with some help from the United Auto Workers union. Yet despite the current crisis, General Motors is still paying dividends to shareholders, the car companies are paying bonuses to executives, and the private-equity billionaires at Cerberus who bought Chrysler are trying to reap enormous rewards from their risky investment. Meanwhile the UAW's Jobs Bank -- which pays laid-off workers for doing nothing -- remains in place.

Of course, we can all hope that shareholders do well, that executives reap handsome rewards for work well done, that the Cerberus billionaires make more billions on Chrysler, and that workers get paid on whatever terms the car companies agree. But we taxpayers shouldn't subsidize any of this.

The only reason we should bail out any private company is the risk that its demise would wreak havoc on the entire economy. Bear Stearns conceivably passed the test; its collapse could have threatened the U.S. financial system, and the government didn't make the mistake of bailing out shareholders or management.

But just what calamity are we trying to avoid by subsidizing loans to Detroit? That we'll all be sentenced to the indignities of driving Hondas, Mazdas or BMWs? Toyota and Honda, the current leaders in hybrids and alternative-fuel technology, did their research and development on their own dimes.

Even if Ford, GM and Chrysler were to go out of business -- and it's highly unlikely that all three will simply cease to exist -- there will be plenty of good cars for Americans to buy. And many will be made in America, even if they carry foreign nameplates. Toyota, Nissan, Honda, Hyundai and other foreign car companies have expanded greatly their U.S. manufacturing operations in recent years. They're doing so because Americans are buying their cars.

As a practical matter, Americans could choose to buy more Detroit cars. Frankly, they should -- considering such outstanding products as the Ford Focus, a fuel-efficient and comfortable compact, and the Chevrolet Malibu, a terrific new mid-sized sedan. But they're not. Americans are voting with their dollars, which is their right.

And what about the precedent the government would set? If we bail out Detroit, where do we stop? The newspaper industry is in financial trouble because more readers and advertisers are turning to the Internet. Newspapers are good for democracy -- Thomas Jefferson said he would choose newspapers over government, after all -- so shouldn't they get low-interest government loans to help them adjust to the Internet? Of course not, and ditto for Detroit.

If Detroit's auto makers would apply more than knee-jerk analysis to what's being proposed, they would reject it quickly. No matter what their spin, including the patently absurd claim that government-guaranteed, below-market loans aren't a bailout, loan subsidies will paint them in the public mind as corporate welfare recipients that can't compete on their own. That can't be good for sales.

More fundamentally, the last thing these companies need just now is more debt. They are leveraged to the hilt, and risk climbing into a financial hole from which they'll never recover. Better to raise money by selling more assets (e.g., Ford's recent sale of Jaguar and Land Rover) or raising more equity -- even if new investors would require management changes or other measures.

All this said, if Detroit's short-sightedness and political expediency make a bailout inevitable, let's make sure taxpayers stand to get rewarded for their risk. In 1980, the government didn't lend any money directly to Chrysler, instead guaranteeing loans to the company made by private lenders, mostly banks, in the amount of $1.2 billion (bailouts, like everything else, were cheaper back then). But in return, the government got warrants to buy Chrysler stock at a very low price. When Chrysler staged its spectacular recovery and paid off the bank loans seven years early, the warrants soared in value and the government earned some $400 million.

Then CEO Lee Iacocca tried to get the government to forego its profits -- he even got into a telephone shouting match with Treasury Secretary Donald Regan. But Regan, backed by President Reagan, stuck to his guns.

One other stipulation: any low-interest loans to develop fuel-efficient cars should be made available to all car companies, not just the Detroit Three. The law passed by Congress last year is framed to make this highly unlikely. But if developing fuel-efficient and alternative-energy cars is deemed worthy of taxpayer subsidies for public-policy purposes, it's just common sense not to put all our eggs in Detroit's basket.

Mr. Ingrassia, a former Detroit bureau chief for this newspaper, won a Pulitzer Prize in 1993 for his automotive coverage. He writes on automotive issues for The Journal, Cond Nast Portfolio and other publications.

Is Beyond Shameless

[FONT=times new roman,times,serif][FONT=times new roman,times,serif]By PAUL INGRASSIA

September 8, 2008[/FONT]

[/FONT]

It was only a matter of time, unfortunately. And now that Michigan is an election-year swing state and Detroit's auto makers are posting sales declines topping 20% each month, the time has arrived. The issue of a government bailout for General Motors, Ford and Chrysler is moving to center stage.

Barack Obama has said yes to this proposal early on, and last week John McCain climbed on board. So much for change and fighting pork-barrel spending. We're moving beyond moral hazard here, folks, and into a moral quagmire. At least the Chrysler bailout of 1980 was structured so that taxpayers could reap a reward for taking a financial risk on the company's future. That's not what's happening now.

<table class="imglftbdy" align="left" border="0" cellpadding="0" cellspacing="0" width="262"> <tbody><tr><td>

This is bad public policy for reasons of philosophy, practicality and precedent. And by the way, this is a dumb idea for the car companies too, simply in terms of their own self-interest.

Philosophically, if the Freddie Mac and Fannie Mae debacles teach us any lesson, it is that subsidizing private profits with public risk is a terrible idea. Implicit government backing has led the managements of these two companies to make reckless investments that have backfired badly. Now government backing has become explicit, and under the plan announced by Treasury Secretary Henry Paulson yesterday, taxpayers likely will pay billions to keep Fannie and Freddie solvent -- with the exact amount uncertain.

The Detroit Three got into their current quandary by making decades of bad decisions, with some help from the United Auto Workers union. Yet despite the current crisis, General Motors is still paying dividends to shareholders, the car companies are paying bonuses to executives, and the private-equity billionaires at Cerberus who bought Chrysler are trying to reap enormous rewards from their risky investment. Meanwhile the UAW's Jobs Bank -- which pays laid-off workers for doing nothing -- remains in place.

Of course, we can all hope that shareholders do well, that executives reap handsome rewards for work well done, that the Cerberus billionaires make more billions on Chrysler, and that workers get paid on whatever terms the car companies agree. But we taxpayers shouldn't subsidize any of this.

The only reason we should bail out any private company is the risk that its demise would wreak havoc on the entire economy. Bear Stearns conceivably passed the test; its collapse could have threatened the U.S. financial system, and the government didn't make the mistake of bailing out shareholders or management.

But just what calamity are we trying to avoid by subsidizing loans to Detroit? That we'll all be sentenced to the indignities of driving Hondas, Mazdas or BMWs? Toyota and Honda, the current leaders in hybrids and alternative-fuel technology, did their research and development on their own dimes.

Even if Ford, GM and Chrysler were to go out of business -- and it's highly unlikely that all three will simply cease to exist -- there will be plenty of good cars for Americans to buy. And many will be made in America, even if they carry foreign nameplates. Toyota, Nissan, Honda, Hyundai and other foreign car companies have expanded greatly their U.S. manufacturing operations in recent years. They're doing so because Americans are buying their cars.

As a practical matter, Americans could choose to buy more Detroit cars. Frankly, they should -- considering such outstanding products as the Ford Focus, a fuel-efficient and comfortable compact, and the Chevrolet Malibu, a terrific new mid-sized sedan. But they're not. Americans are voting with their dollars, which is their right.

And what about the precedent the government would set? If we bail out Detroit, where do we stop? The newspaper industry is in financial trouble because more readers and advertisers are turning to the Internet. Newspapers are good for democracy -- Thomas Jefferson said he would choose newspapers over government, after all -- so shouldn't they get low-interest government loans to help them adjust to the Internet? Of course not, and ditto for Detroit.

If Detroit's auto makers would apply more than knee-jerk analysis to what's being proposed, they would reject it quickly. No matter what their spin, including the patently absurd claim that government-guaranteed, below-market loans aren't a bailout, loan subsidies will paint them in the public mind as corporate welfare recipients that can't compete on their own. That can't be good for sales.

More fundamentally, the last thing these companies need just now is more debt. They are leveraged to the hilt, and risk climbing into a financial hole from which they'll never recover. Better to raise money by selling more assets (e.g., Ford's recent sale of Jaguar and Land Rover) or raising more equity -- even if new investors would require management changes or other measures.

All this said, if Detroit's short-sightedness and political expediency make a bailout inevitable, let's make sure taxpayers stand to get rewarded for their risk. In 1980, the government didn't lend any money directly to Chrysler, instead guaranteeing loans to the company made by private lenders, mostly banks, in the amount of $1.2 billion (bailouts, like everything else, were cheaper back then). But in return, the government got warrants to buy Chrysler stock at a very low price. When Chrysler staged its spectacular recovery and paid off the bank loans seven years early, the warrants soared in value and the government earned some $400 million.

Then CEO Lee Iacocca tried to get the government to forego its profits -- he even got into a telephone shouting match with Treasury Secretary Donald Regan. But Regan, backed by President Reagan, stuck to his guns.

One other stipulation: any low-interest loans to develop fuel-efficient cars should be made available to all car companies, not just the Detroit Three. The law passed by Congress last year is framed to make this highly unlikely. But if developing fuel-efficient and alternative-energy cars is deemed worthy of taxpayer subsidies for public-policy purposes, it's just common sense not to put all our eggs in Detroit's basket.

Mr. Ingrassia, a former Detroit bureau chief for this newspaper, won a Pulitzer Prize in 1993 for his automotive coverage. He writes on automotive issues for The Journal, Cond Nast Portfolio and other publications.