Hey everyone, a ton of great points on here - as one of Leasehackrs biggest sponsors, I speak with the owners Victoria and Michael on a monthly basis and our company is the exclusive official partner of Leasehackr's Equityhackr program since 2021 (if you are familiar). 11 Years in the industry, I have debated many a times the Lease vs Buy debate.

Here is the short answer; It completely depends on each person, their financial preferences and discipline and how saavy you are with navigating the automotive markets.

Simply stating leasing is evil and the dumbest financial decision is just plain wrong, respectfully. Likewise, certain circumstances leave a purchase being the best option over a lease. It is completely circumstantial, however the overlap is great.

Scenario:

Let's say you need a new car, you are getting married soon, probably having kids in the next few years, saving up cash for the wedding and a house and really need stability. Assuming we are talking about a normal $30k car, say a CX-30, you can either finance the car or lease it; you have about 10% to put out of pocket. You could finance it, secure a nice low APR on a 60 month finance and get a payment of $500-$550/mo but that's a tight payment monthly for you with all the expenses coming up. With the same cash out of pocket, you could lease it for 3 years with a 60% residual and a $300/mo payment. Since *most* states will only tax you on the portion of the lease, you are truly only paying for roughly 40% of it over a 3 year period, then at the end of that lease you land at your residual of $18k. Let's say you kept great care of the car, its value has held up and its worth $20k, car fits your needs, you can take all that money you saved and put it towards the payoff and buy the rest of the car at that point. Essentially the same net outcome as the original finance, but you have a mid-point where you can stop and evaluate your next move without committing to the liability of the car. Here's an alternative version, lets say you get to the end of the lease but had unfortunately had 2 accidents with the car during that time and the value of the car tanked down to $13k. Do you want to buy it for $18k? Instead, you just got an out and can send that paperweight back to the bank to lose money on, now you have a fresh slate to get into that new CX-90 since you're married now and just had triplets, congrats! If you had financed that car and needed to consider a trade after 3 years (life changes a lot in ours 20s-30s) you would have both been paying double the payment for those 3 years ($9k added cost) and your payoff would be lower, lets call it $13k, the same its worth. You might be getting out clean, but you didn't gain anything for the trouble other than paying a higher payment.

In short, its not that leasing gets you ahead - but it can mitigate liability, and in terms of new cars, liability is a big elephant in the room (in terms of depreciation and flexibility).

But what about EVs, PHEVs? Lease 100000x over. Why? They depreciate like rocks and have tons of incentives to lease.

Scenario:

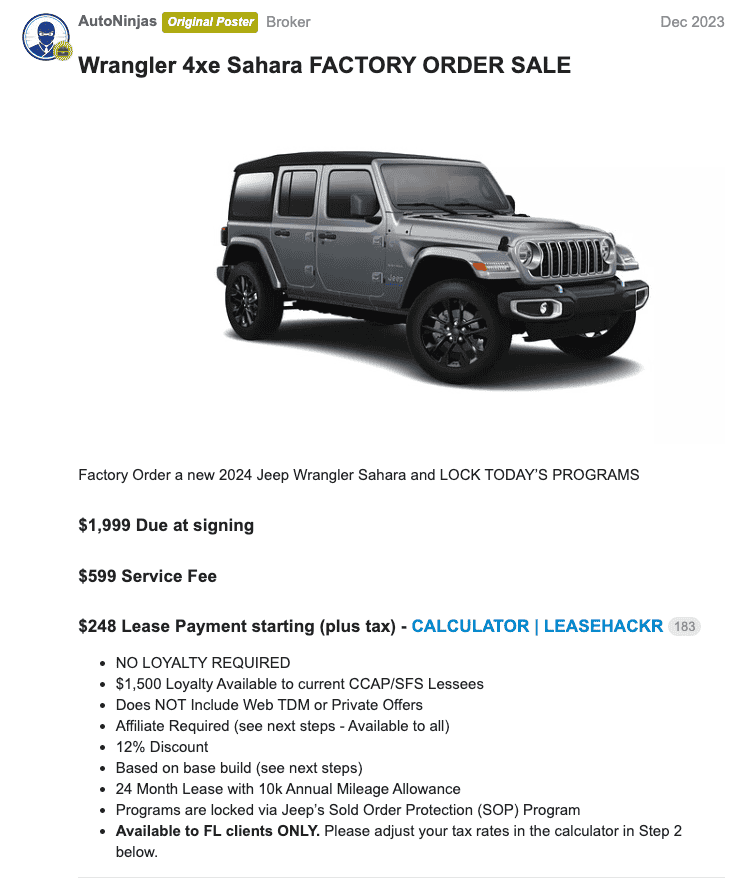

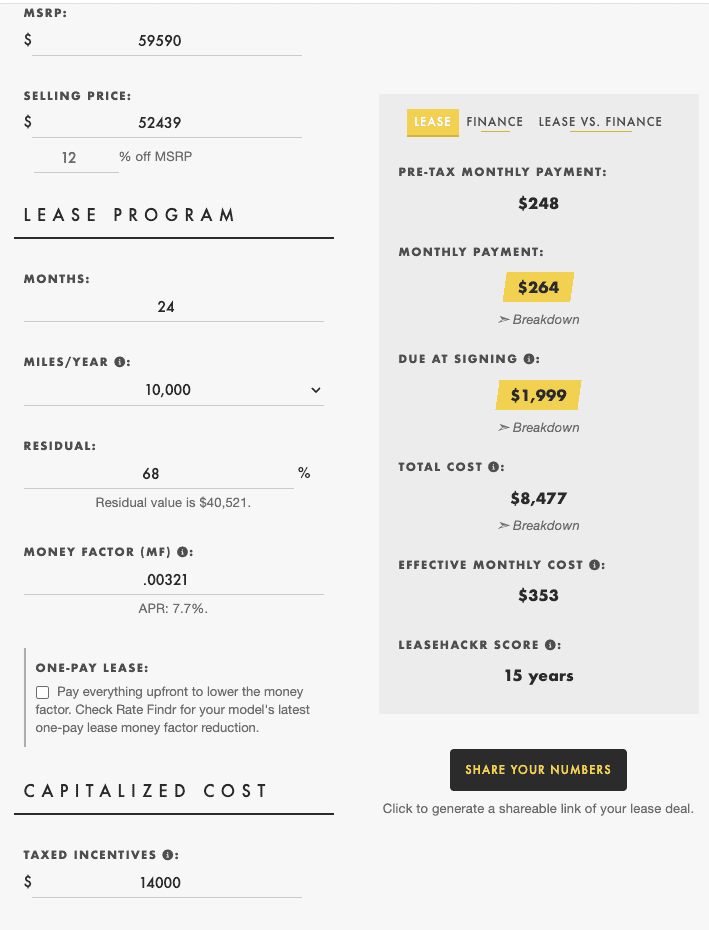

You want a fancy new Jeep Wrangler 4xe, or just need a CHEAP local car to drive around. You find a nice $60k Sahara you like. With the new rules on the Tax credits for purchases, you can buy this sucker with a whopping $3,750 in rebates and maybe if Jeep is generous they are tossing an extra $1,000 in rebate cash on top for you to buy one. The $3,750 comes back on your personal taxes so you are really getting a $1k rebate up front, buying your new Jeep for $59k (not using dealer discounts to keep things apples to apples in this comparison, dealer discounts are definitely available).

But wait, what if we looked at a lease? Well, rebates just shot up to $14,000 because Jeep wants you to lease so they put extra rebates on it, also that tax credit only got cut for purchases, leases since they are technically a business tax credit are still at $7,500 if you lease. Now just from that large of a difference alone, you can now already settle this that a lease in this case will bring you on top, especially if you intend to own it and just pay it off at the end of the lease in order to capture an extra $10k in rebates. But I can raise this one up a notch, I would still lease this even if I knew I was just throwing it away at the end of the lease with zero chance of equity or buying it for favorable terms. Why? Well because now you scored a massive discount from the dealer on top and you find a deal like we offered recently.

$60k Jeep Wrangler, 2 year lease, $1999 out of pocket including taxes and fees, $264/mo all in. The average monthly payment right now in the US is $726/mo, you just got a brand new $60k Jeep for a third of the national average payment with minimal out of pocket cost and are set for the next 2 years. Now apply this type of deal to someone who is a middle class or higher earner that is honest with themselves, who just wants peace of mind, a low calculated payment and no surprise expenses or downtime. A lease starts to make a lot of sense. Imagine he bought this instead, he would be into it for about $55k with a discount after all said and done and it would be worth about $35k in 2 years, a depreciation of over $1k per month. Leave that cost on the manufacturer/bank - lease it.

Ultimately, every scenario is unique and there is no such thing as Leasing vs Purchasing is better without considering nuance, but IMO leasing (so long as you are informed and know what you are doing) offers a lot more flexibility and has fewer downsides and risks. Imagine being the person that bought a Hydrogren powered Toyota and didn't want to lease it because debt it evil.

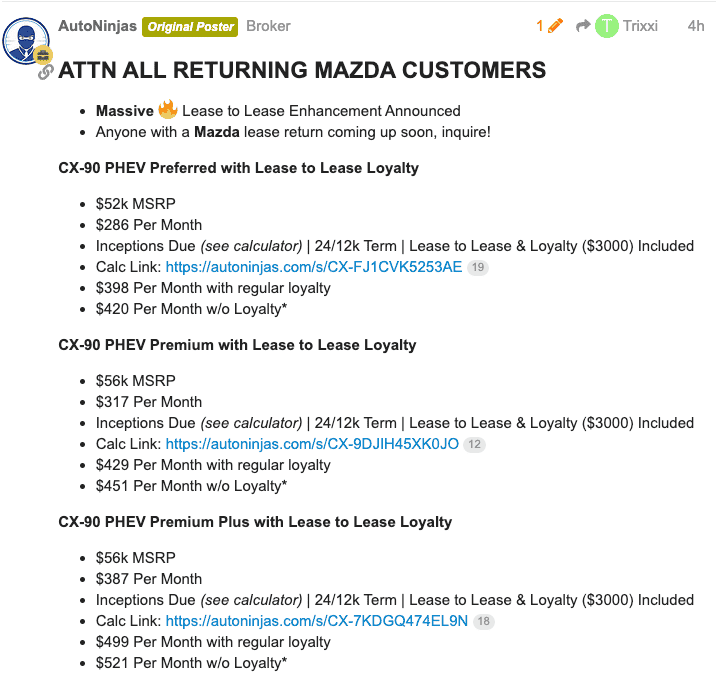

Last and final anecdote, my business partner is driving a Maserati GranTurismo lease right now, 12 month lease. $190k MSRP car. How much is that costing him over his 12 month lease? $20k? $30k? Well, hes a saavy SOB and hacked the hell out of super short-lived lease program with specific incentive programs and found the right dealer to play ball, he paid a total cost of $5k for the lease. One pay, paid up front. While this sounds insane and unimaginable, these lease deal hacks exist and come and go every month. Look at what we just posted on the CX-90 PHEVs, if you are a current Mazda lessee you get up to an extra $3k in rebates plus $1k in lease payment forgiveness on your current lease, we're going to sell out of inventory this month with the lease programs Mazda has this month. Sure, you're in a lease "cycle", but if you aren't committed and disciplined to the debt-free life and will drive a car into the ground, be real with yourself, theres worse financial decisions out there. These are cars, not gold.